We invite investors and their professional advisers

You will have access to Member events where we will showcase new investments, provide the opportunity to meet the management teams and network with like-minded individuals.

Open Investment Opportunities

Afon Technology

Sector: MedTech

Total Fundraise: £4 million

Available Investment: £2,500,000

Status: Open

Tell me more

Afon Technology has developed Glucowear – a non-invasive, real time, blood glucose monitor for the diabetic and wellness market.

Comprising a sensor using microwave signals to detect glucose signals in the blood, Glucowear is worn on the wrist just like an Apple watch or Fitbit. Glucowear is completely non-invasive. There are no needles so no pain and no delay in recording the glucose level.

Glucowear aims to enhance the take-up and daily management programs for the 537 million diabetics worldwide and the wellness market, estimated to be worth $116 billion in 2021.

The device is currently in its third clinical trial in the NHS Joint Clinical Research Centre in Swansea. Afon Technology has partnered with an AI company that, along with the company’s in-house statisticians, have developed a deep learning neural network that is providing data comparable to existing continuous glucose monitors (CGMs) but without the skin penetrating needle. The development pathway includes completion of the current NHS trial and a further trial at Profil, before achieving CE mark later in the year.

The Company requires £4 million for 11.66% of the Company, at a pre-money valuation of £30.3 million to complete the clinical trials and achieve CE mark. Potential investor returns are 3x to 6x.

Biosceptre International

Sector: BioTech

Total Fundraise: £8.4 million

Available Investment: £8,000,000

Status: Open

Tell me more

Biosceptre International is a UK and Australia based biopharmaceutical company pioneering the development of a CAR-T immunotherapy for the treatment of a broad range of cancers. The company has identified a unique target, nfP2X7, which is only found on cancer cells, but not on normal cells.

This target will be used by state-of-the art immunotherapies to specifically target and kill the cancer cells, whilst leaving normal cells unaffected. This should result in a major reduction in the unpleasant side effects currently associated with conventional chemotherapy and immunotherapy.

Biosceptre has also developed an innovative, patented technology called BRiDGE™ CAR increasing the patent portfolio to >185 granted patents in 15 families. The BRiDGE™ CAR technology enables the use of existing monoclonal antibodies in CAR-T applications, extending their therapeutic approach, as CAR-T systems are more effective at killing cancer cells than monoclonal antibodies alone. It also has the advantage that multiple different antibodies to the target cancer cells can be used in BRiDGE™ CAR leading to a greatly reduced chance of cancer cells escaping from the therapy by losing their expression of the target.

The company has a world class leadership team with the Scientific Advisory Board led by Sir Greg Winter, winner of the Nobel Prize for Chemistry 2018. In 2020, Norcliffe Capital raised £6 million for Biosceptre to progress its CAR-T development program for its haematological, solid tumour and monoclonal antibody programs.

The Company requires £8.4 million for 2.04% of the Company, at a pre-money valuation of £411 million to finalise their lead molecules prior to their phase 1 clinical trial in early 2024.

Aureum Diagnostics

Sector: MedTech

Total Fundraise: £3.51 million

Available Investment: £700,000

Status: Open

Tell me more

Medical diagnosis is about to undergo a revolution based on the next generation of cheap, mass manufacturable, electrochemical sensors like those to check blood sugar levels in people with diabetes. Aureum Diagnostics is a spin-out company from the world-leading Innovation Centre at the University of Strathclyde and is based on the work of Dr Corrigan and his team.

The team have already demonstrated the ability of their electrochemical platform to detect COVID in 2 minutes and to detect critical markers of sepsis, where a one hour delay in diagnosis can result in a 10% increase in mortality. The platform is ideally suited for rapid diagnosis of many conditions at the point of care and for the rapid diagnosis of COVID in sites like travel hubs, schools, workplaces and at home.

The Company requires £3.51 million for a total investor shareholding of 75.6% of the Company, at a pre-money valuation of £1.13 million to develop two types of readers: highly sensitive impedimetric readers and cheaper amperometric readers which use similar technology to glucose monitoring strips. Potential investor returns are 7x to 15x.

SMi Drug Discovery

Sector: MedTech

Total Fundraise: £3.64 million

Available Investment: £800,000

Status: Open

Tell me more

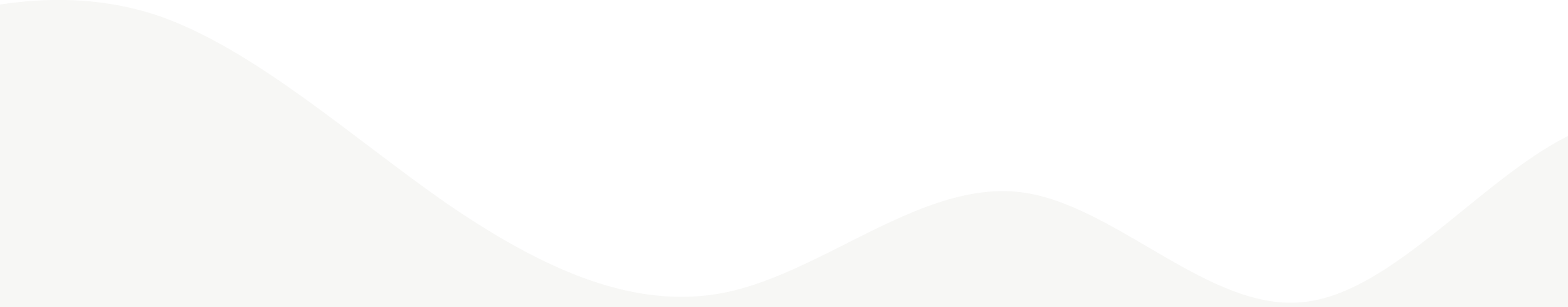

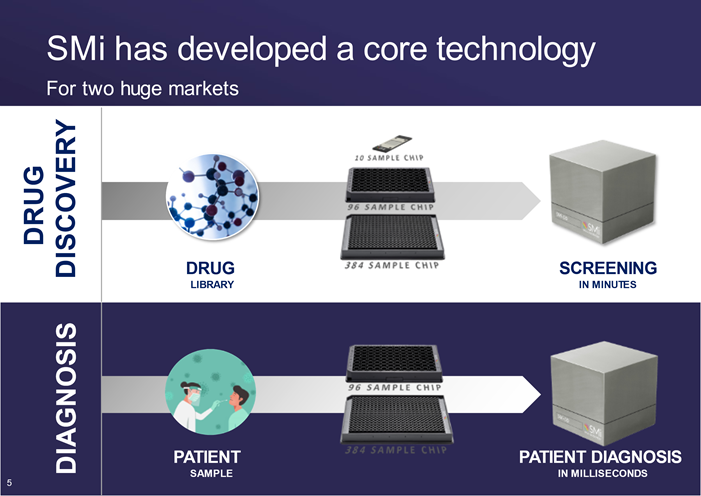

SMi Drug Discovery has developed a transformational, new, optical technology that will have far-reaching benefits in the fields of diagnosis and drug discovery. SMi’s technology is a variant of super resolution microscopy, an area which was the subject of Nobel Prizes in 2014 and 2017. SMi have been awarded a non-dilutive £1.9M UK Innovation grant for the development of their platform for virus diagnosis in large central laboratories.

The system can identify and count individual virus in a sample in 50 milliseconds, with a sensitivity equivalent to the gold standard PCR tests. SMi’s technology complements Aurem’s in that is designed for large central locations.

SMi’s platform’s second application is in speeding up drug discovery where cutting a year off development can save > $100 million. During drug development, scientists need to know how a drug binds to its target, exactly where and for how long. SMi’s technology is revolutionary as it can visualise hundreds of thousands of these interactions whereas current techniques provide only average data. A good analogy is that current techniques are like trying to determine the exact composition of traffic from the noise of vehicles whereas, SMi’s technology photographs and counts every bus, car, lorry and bike.

The Company is raising £3.64 million for 39.6% equity, at a pre-money valuation of £4 million. Potential investor returns are 8x to 16x.

COMING SOON

Aureum Diagnostics

Medical diagnosis is about to undergo a revolution based on the next generation of cheap, mass manufacturable, electrochemical sensors like those to check blood sugar levels in people with diabetes. Aureum Diagnostics is a spin-out company from the world-leading Innovation Centre at the University of Strathclyde and is based on the work of Dr Corrigan and his team.

SMi Drug Discovery

SMi Drug Discovery has developed a transformational, new, optical technology that will have far-reaching benefits in the fields of diagnosis and drug discovery. SMi’s technology is a variant of super resolution microscopy, an area which was the subject of Nobel Prizes in 2014 and 2017. SMi have been awarded a non-dilutive £1.9M UK Innovation grant for the development of their platform for virus diagnosis in large central laboratories.